Commercial real estate cap rates are an important part of the investment process. In this guide, we will discuss everything you need to know about cap rates and how they can impact your investments. We will cover topics such as what a cap rate is, how to calculate it, and how to use it to make informed investment decisions. If you’re looking to invest in commercial real estate, then this guide is for you!

The commercial real estate cap rate, more commonly known as the capitalization rate, is a way for CRE investors to evaluate the risk and potential return of an asset or property. Cap rates are typically given as percentages that range from 3-20%.

Key Takeaways

- The capitalization rate, also known as the commercial real estate cap rate, is the rate of return used by CRE investors to assess the risk and potential return of an asset or property.

- Cap rates are usually expressed as percentages ranging from 2% to 30%.

- When comparing investment properties, capitalization rates are commonly used. Compared to securities investments, it has a similar expected effective rate of return.

What’s a Cap Rate in Commercial Real Estate?

CRE investors use the cap rate, or the capitalization rate, to gauge the potential return on an asset or property in order to gauge the level of risk and the potential return that the asset will offer. It is usually expressed as a percentage, ranging between 3 and 30% when it comes to cap rates. Investors determine the level of risk they want to take based on how long it will take them to regain the original investment amount they put into the investment.

Investment property with a low cap rate generally has a relatively higher value as well as a lower risk as a result. On the other hand, a high cap rate indicates, on the other hand, that the property is less expensive, but at the same time, has a higher return (and greater risk).

Regardless of the fact that cap rates help investors understand the potential of a property, they will not necessarily provide value in isolation. It is better to use cap rates as a tool to compare similar properties rather than as a measurement of their value. By retaining the cap rate even if you don’t close on a deal, you’ll have a better idea of how to benchmark future deals.

Despite the fact that the cap rate is one of the most important metrics to consider when considering pipeline acquisitions, it is far from being the end-all metric. Commercial real estate cap rates do not include mortgages or financing arrangements as a factor in calculating the cap rate. This is among many limitations of commercial real estate cap rates.

As a result, it assumes that the purchase will be made in cash. Considering only current rents, this figure does not consider factors such as those mentioned below that may affect future rents:

- Utilize your resources

- Money is worth more over time if it is invested properly

- Renovations or improvements to the property

Due to this, cap rates may not always capture the complete market potential of a property based on its cap rate. The internal rate of return is one of the metrics that investors look at in order to make their analyses more holistic.

Since cap rates are not fixed, they are affected by a variety of factors, including rent increases, additional tenants signing up, and changes in operating costs. There are several commercial real estate metrics that investors use to evaluate the performance of their investments, but they are specific to the commercial real estate market.

Similarly, private equity multiples are a measure of risk that is used in the market for private equity.

Why is Cap Rates Used in Commercial Real Estate?

A capitalization rate acts as a comparison metric when you’re checking out potential investment properties. It works similarly to expected effective rates of return for securities investments. For example, if you invest $100,000 in securities at 4.5%, that’s the same as investing $100,000 all-cash in a property with a cap rate of 4.5%.

Real estate investors can use this statistic to figure out where they should invest their money.

How Do Cap Rates Work in Commercial Real Estate?

The Strength of the Tenant

An increase in the number of tenants in a property can quickly affect the net operating income of the property. A preferred developer for a national tenant such as Walgreens, or one of their credit tenants, says they are building them a space in the middle of a city’s growth when it is a moment of growth.

There is an investor who buys the project from the developer at a triple net cap rate of 8%. In this case, what is the problem that needs to be addressed?

If a lease doesn’t say otherwise, the rental rate will steadily go up over the course of 15 to 20 years for credit tenants. Even though this might look like it’s doing well from the outside, chances are future investors won’t see it that way compared to the first one. The 8% attributed to the tenant is precisely why this happens.

An investor might be in hot water if they buy the space at an unfortunate time in the market. If Walgreens decides to move out after its lease expires, it will be up to the owner to find a new tenant for the space.

The 8% cap rate triple net is now invalid since the market rate may be lower than it was 15-20 years ago, so the tenant will most likely have to pay less rent.

The 8% cap rate triple net is no longer applicable in this situation. In a Walgreens location, it would be very rare for that to occur after 15-20 years, however it’s not impossible for tenants living in rural areas like Dollar General where their stores are more spread out.

The Timing of the Acquisition

Subtracting a property’s operating expenses from its generated revenue gives you that property’s net operating income. The expenses are tallied every year, so the cap rate may gradually change if these necessary expenditures grow (or decrease) over time.

You have a lot of variables in place that can influence the expenses and revenue of a property, which is why timing is a significant factor in determining cap rates when you own a property – don’t expect it to remain the same throughout the duration of your ownership.

Potential Vacancies

Another issue to examine is whether or not the space is fully rented. Because an investment has a low cap rate, an investor may believe it is safe (usually, the more you stand to gain, the more you stand to lose).

If a building is not fully leased, the NOI will be lower than if it were at full capacity; in turn, this affects the cap rate.

The Location of the Asset

The denominator (market value) in our cap rate equation is determined, to a large extent, by the location of the property. If the house being evaluated is situated in an upscale area, then naturally the corresponding cap rate will be lower.

Why?

The value of the property may go up quicker than your NOI, and it might be seen as more dependable. The safer an asset is, the lower your cap rate will be because there’s less investment risk.

What is a good cap rate in Commercial Real Estate?

The cap rate for rental properties

For rental properties, the cap rate is a measure of the yield that can be expected from the property in the next year. The calculation is based on net operating income, excluding below-the-line expenses such as debt payments. Alternatively, the cap rate can be thought of as the opposite of the valuation multiple.

In other words, if you purchase a property with a 5% cap rate and it earns $100,000 per year in Net Operating Income, the property is worth $100,000 divided by 5%, or $2,000,000. The figure can also be viewed as a 20x multiple, where $100,000 multiplied by 20 equals $2,000,000.

A cap rate calculation is useful because debt and interest are not included. As a result, it is possible to compare various types of rental properties based solely on their initial investment, rather than the amount of debt required to acquire them. Although particular financing options will vary, a cap rate can be used to forecast potential returns on a rental property based on its own attributes.

Cap Rate Ranges by Commercial Property Type

The table below provides a quick reference of typical cap rate ranges for various commercial real estate asset classes. These ranges reflect general market averages and can be helpful for investors to benchmark potential acquisitions and assess relative risk/return profiles across different property types.

Keep in mind that these ranges are not absolute – a property’s specific cap rate is influenced by many factors beyond just asset type, such as location, building quality, tenant mix, lease terms, growth potential, and more. Nonetheless, the table offers a starting point to understand how cap rates tend to vary across the major commercial property sectors.

| Property Type | Typical Cap Rate Range |

|---|---|

| Multifamily | 4% – 7% |

| Office | 5% – 8% |

| Retail | 5% – 8% |

| Industrial | 6% – 9% |

| Hotel | 7% – 12% |

As shown, multifamily assets generally transact at the lowest cap rates, reflecting their relatively low-risk profile due to stable occupancy and consistent cash flows. On the other end of the spectrum, hotels tend to have the highest cap rates given their operationally intensive nature and vulnerability to economic downturns. Office, retail, and industrial properties typically fall somewhere in between.

Astute investors must look beyond these high-level categorizations and carefully examine an individual asset’s strengths, weaknesses, and market positioning to determine an appropriate cap rate when underwriting a prospective acquisition. The savviest investors also stay on top of market trends to identify opportunities where a property’s cap rate may not reflect its full potential based on its ability to enhance operations, make capital improvements, or capitalize on strengthening submarket fundamentals.

What is a good cap rate on an investment property?

A reasonable cap rate for an investment property is generally one that closely resembles market averages. If a noticeable discrepancy exists between the rates, this may mean that the property is undervalued.

Cap rates can help investors determine whether a property is a good fit for their investment portfolio, and they can also be used to analyze existing properties.

If a property’s cap rate is much higher than other comparable properties, the property may be undervalued or the income could be too high. If cap rates are lower than what is average for the market, then it would be a wise investment.

A lower-than-usual cap rate could be a sign that a well-informed investor has the chance to improve on an underperforming investment. However, one cannot glean this information just by looking at the cap rate. You must understand what is happening in general in the market as well as with that particular property before making any decisions.

What is a good cap rate on a commercial property?

In commercial real estate transactions, a good cap rate varies depending on whose side you are on. When it comes to the initial cap rate, the exit cap rate, and the holding cap rate, investors look for different things in each of these three situations.

As the real estate market expands, cap rates will begin to decrease, which in turn will lead to cap rate compression. The reason for this is that cap rates and property values are inversely related. Property prices may rise as demand for property rises too quickly, causing the market to heat up too quickly. As a result of a fall in borrowing costs, it is also possible for buyers to demand more from sellers during this period.

It can be advantageous for a company to have a lower capitalization rate in this situation.

In order for cap rates to rise, the process by which they do so is known as cap rate expansion. There are many factors that can cause these situations to occur, such as an increase in the cost of borrowing, oversupply in the market, or worsening economic conditions in the market.

The cap rate can increase for different reasons, like when an anchor tenant leaves or the building becomes damaged. This creates a perception that the property is riskier, which could be appealing to buyers who are willing to take on more risk if it means getting a discounted price.

Average Cap Rate By Property Class (Class A, Class B & Class C)

It is common for cap rates to differ depending on whether you are purchasing a property in class A, B, or C.

A property can be classified into Class A, B, or C according to a number of different factors that are not easily defined. It is often thought, on the other hand, that Class A office buildings are of the finest quality, are situated in the most convenient locations, and/or are in the most recent condition (either newly constructed or recently renovated). There is a wide range of properties in the Class C classification, which tend to be older, located in less desirable areas, and in need of considerable rehabilitation. There is a difference between a Class A property and a Class C property as it is intermediate between the two.

There are a number of ways in which these scenarios can fall apart, for example, if the property is in very good condition, but in an unattractive neighborhood, or if the property is in new condition, but not in the best condition. It is important to understand that, regardless of what the property’s “class” is, its cap rate will be affected by it. The cap rate of properties classified as class A is usually lower than the cap rate of properties classified as class B or class C.

If you want to know more about the best way to buy commercial real estate, make sure to check out an article that I have written about it here.

What Factors Affect the Cap Rate?

1. Expected Returns

Some investors prefer stability and a steadier income, even if it means earning less money overall.

Some investors are willing to take on more risk if it means potentially receiving a larger reward. The expected rate of return, or necessary rate of return, is the percentage of return an investment must make in order for the investor to accept it given its unique attributes like cash flow volatility and availability of substitutes.

2. Income Growth

Even if the cap rate does not change, improvements in Net Operating Income can cause large changes in property value (and prospective returns).

For example, let’s consider a 7% cap rate property. With the same cap rate, a $1 rise in NOI would mean a $14.28 increase in property value ($1 / 7%). Now, let’s see how this calculation applies to a larger scale.

A commercial apartment or office building has an NOI of $100,000 in the first year. With lease escalations, market fundamentals, and cost-cutting efforts, the NOI rises to $175,000 by the tenth year. Consequently, this additional $75,000 in NOI adds $1.07 million dollars to the property’s value at a cap rate of 7%.

The more an investor predicts that a property will generate revenue, the more they are willing to pay for it.

3. Changes in Return & Growth Expectations

Generally speaking, a rental property’s rental income stream is more predictable and less risky if there are many years left on its existing tenants’ leases. There is a significant risk of vacancy and income risk on a property if a tenant, especially a major tenant, has just one or two years left on their lease. In general, longer leases are associated with a lower cap rate and a lower level of risk. The opposite is also true: shorter leases are associated with higher market cap rates and higher risk, respectively.

4. Financial Strength of Tenants

There is less danger in a property packed with top-notch renters who can be counted on to fulfill their rent payments than in a property full of local tenants whose financial status is unknown. A target or subway, for example, will always attract a lower cap rate than a property with amenities such as a local coffee shop and restaurant.

5. Remaining Lease Duration

There is less danger in a property packed with high-quality renters who can be counted on to fulfill their rent payments than in a property full of local tenants whose financial status is unknown. A Walgreens or Mcdonald’s, for example, will always attract a lower cap rate than a property with a local coffee shop and restaurant.

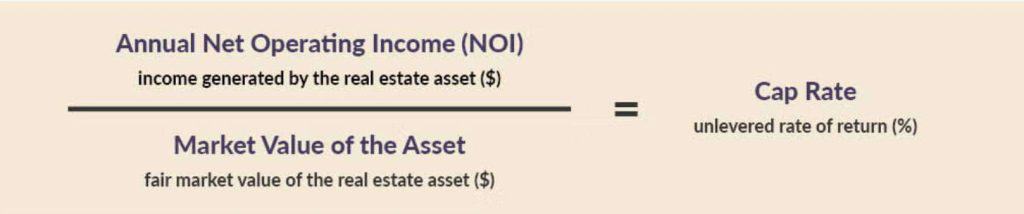

How to calculate cap rate for commercial properties

The annual net operating income of a property is divided by its market value in order to calculate the cap rate. For example, a property worth $10 million that generates $500,000 in NOI would have a cap rate of 5% if it generated $500,000 NOI each year.

Why is a cap rate important when purchasing an office building?

Cap rates allow you to get a sense of the risk levels in a specific market and evaluate how specific properties fit into a specific market environment. An investor looking for a 100-unit multifamily complex, for example, will want to examine properties in various locations in the United States. When analyzing potential purchases, investors should research cap rate real estate data to determine typical cap rates for that property type and location.

Additionally, researching cap rate commercial real estate trends over time can provide useful insights into the market. Generally, investors look for multifamily properties with cap rates of at least 6-8%, but the optimal cap rate for rental property depends on factors like location, age, occupancy rates, and more. Taking the time to research cap rates leads to more informed investment decisions.

Cap Rate Vs. ROI

Cap rate and ROI are two terms that are frequently used when discussing real estate. But what do these terms mean, and how are they different?

Cap rate is a measure of return on investment. It’s calculated by dividing the net operating income (NOI) by the purchase price of an asset.

An investment’s return on investment is calculated by dividing its net profit (or loss) by its initial cost.

Both figures can be helpful in determining whether or not to buy an asset, but they have different purposes: cap rate measures the ability to pay back debt while ROI measures profitability.

Why Cap Rates Are Important When Selling Commercial Real Estate

A capitalization rate is a metric used to determine a commercial rental property’s profitability.

Generally speaking, a high cap rate implies that the business will generate a lot of revenue compared to the size of the initial investment. Risk, as well as market dynamics in the local area, are also other factors to be considered.

What’s a Good Cap Rate

The Capitalization Rate, commonly referred to as the “Cap Rate,” is a fundamental concept in commercial real estate, acting as a tool to evaluate the potential return on investment for a property. Yet, one of the most frequently asked questions is: “What’s a good cap rate?” The truth is, the answer varies depending on various factors, including the property type, location, and the current state of the market.

Let’s start by briefly reiterating the definition of a cap rate. It is calculated by taking the Net Operating Income (NOI) of a property and dividing it by the property’s current market value or purchase price. The formula looks like this:

For instance, if you’re looking at a commercial property with an NOI of $100,000, and it’s on the market for $1,000,000, the cap rate would be:

\text{Cap Rate} = \frac{$100,000}{$1,000,000} = 0.10 \text{ or 10%}

Now, onto the heart of the matter: understanding what constitutes a ‘good’ cap rate. Here are several factors to consider:

- Property Type and Risk Profile: Different types of properties inherently carry different levels of risk. For instance, a multi-tenant office building in a thriving business district might have a lower cap rate (suggesting a lower return but possibly lower risk) compared to an industrial warehouse in a more isolated area. Generally, a higher cap rate indicates a higher perceived risk and thus, potentially, a higher return to compensate for that risk.

- Location and Market Dynamics: In prime areas, where there’s high demand and limited availability, properties might fetch lower cap rates. For example, a retail store in Manhattan might have a cap rate of 4%, while a similar property in a small town might offer a cap rate of 8%. The difference is largely due to the perceived stability and growth prospects of these locations.

- Interest Rates and Economic Conditions: During periods of low-interest rates, investors often accept lower cap rates because alternative investments, like bonds, may offer even lower returns. Conversely, during times of economic uncertainty or rising interest rates, investors might seek properties with higher cap rates to compensate for increased risks.

- Individual Investment Objectives: What’s ‘good’ for one investor might not be for another. A retirement fund looking for stable, long-term returns might be content with a lower cap rate in a prime location, while a private investor might seek properties with cap rates above 8% to achieve a quicker return on investment.

So, in essence, there’s no universally ‘good’ cap rate.

However, as a rule of thumb, a cap rate between 4% to 10% is common for many commercial real estate investments in the U.S. Always ensure that the rate aligns with your financial objectives, risk tolerance, and market knowledge.

Lastly, remember to consult with a commercial real estate professional when evaluating potential investments. Their insights can provide a more nuanced understanding of the cap rates suitable for your specific circumstances.

Commercial Real Estate Cap Rate FAQs

What is a healthy cap rate for a rental property?

It is recommended that cap rates be between 4% and 12% for a healthy property. It is possible to consider 4% to be a reasonable cap rate if you are living in an area where there is high demand and high costs, such as New York City or Los Angeles. In areas with less demand, such as parts of a developing neighborhood or rural neighborhoods, cap rates are more likely to be around 10% or higher than in higher-demand areas.

What is the 2% rule in real estate?

According to the 2% Rule, if the monthly rent for a specific property is at least 2% of the purchase price, the investor will most likely generate a positive cash flow.

Here’s the formula: monthly rent/purchase price = X.

Determining whether a property is likely to cash flow begins with finding out if the X (decimal equivalent of 2%) is less than 0.02. If it’s not, then you know that the property isn’t 2%. However, if it’s 0.02 or higher, there’s a good chance that it will cash flow.

Most investment properties will have three numbers on the listing whether they are placed on Roofstock, the MLS, or any other listing site: the sales price, the monthly or annual rental income, and the selling agent’s phone number. With only the property price and monthly rental amount, you can rapidly evaluate whether the rental property fits the 2% Rule.

Will cap rates go up in 2023?

A report by CBRE Econometric Advisors indicates that US inflation will peak this summer, which will ease the pressure on the Federal Reserve to tighten monetary policy further in the coming months. There is also the possibility that inflation will remain high throughout the rest of this year and into 2023 as well. A scenario such as this would force the Fed to take more aggressive measures in the future, which could result in an increase in interest rates by a considerable amount, potentially leading the economy into a recession by the year 2023.

There is a possibility that inflationary pressures could benefit properties that are about to expire their leases, resulting in higher nominal rents than what was anticipated. There are several factors to consider when it comes to determining the performance of an investment property.

There is a good chance that aggressive monetary policy will result in higher cap rates in 2023 as a result of persistently high inflation, perhaps by 20 basis points more than CBRE Econometric Advisors is currently forecasting. In order to maintain rent stability, stronger growth in rental rates cannot be tolerated.

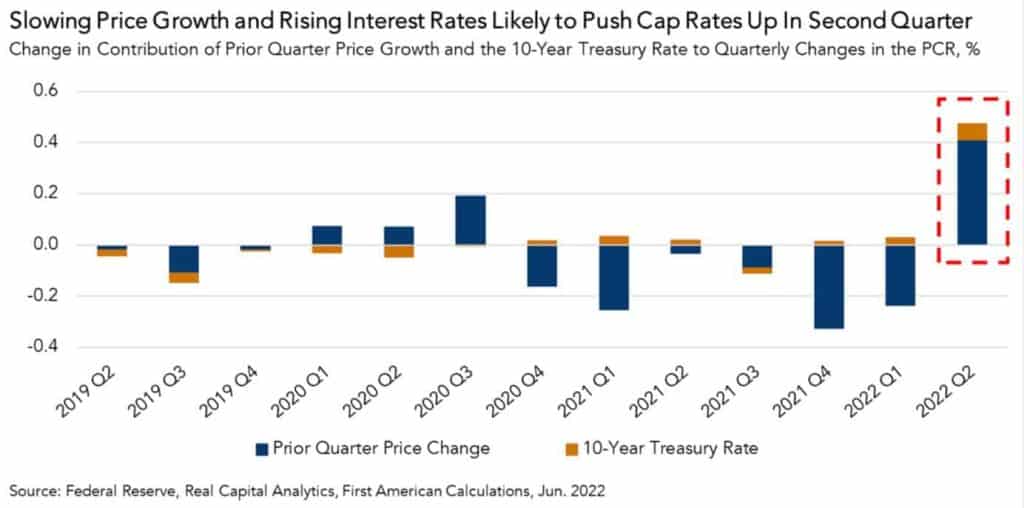

What happens to cap rates when interest rates rise?

Despite higher interest rates contributing to the potential cap rate’s increase, slower CRE price growth will be a far greater contributor to the potential cap rate’s rise in the second quarter, as shown in the chart below.

Is a high or low cap rate better for the seller?

In the case of sellers, low cap rates are more beneficial than high cap rates. As a general rule, it is assumed that lower rates refer to the property being expensive, so it would make sense for them to sell their property at a lower price.

Conclusion

Investing in commercial real estate can be a great way to earn passive income and build long-term wealth. But before you invest, it’s important to understand what cap rates are and how they’re calculated. This guide provides a complete overview of everything you need to know about commercial real estate cap rates. If you have any questions or would like more information, please call or schedule a free consultation. I’d be happy to help you get started on your journey to financial freedom through real estate investing!