Commercial real estate can be a lucrative investment, but knowing what you’re doing is important before making an offer. In this guide, I’ll walk you through the process of making an offer on a commercial property. I’ll discuss how to buy commercial property effectively and even how to make smart investment decisions. So whether you’re a first-time investor or just looking for some tips on making an offer, this guide is for you!

Key Takeaways

- When making an offer, include specifics like purchase price, basic terms of financing, and other contingencies.

- Research the commercial property you’re interested in and make sure it meets your needs before putting in an offer.

- Have a professional real estate agent negotiate with the seller on your behalf to ensure that you get a fair deal.

What Makes Offers Stand Out: My Experience Getting Deals Accepted

After years as a commercial broker, I’ve learned that one thing consistently helps me get offers accepted where others fail: proactive communication and thorough preparation. This approach has worked whether I’m representing buyers, sellers, tenants, or landlords.

Understanding the Commercial Real Estate Offer Process

Explain the key phases of the offer process, including broker brochures, seller financials, your own financial analysis, and final offer formulation.

The Power of Clear Communication

I once worked with a tenant interested in leasing an entire floor of an office building. The tenant was a nonprofit focused on homeless services, and while the space itself was ideal, the landlord was initially hesitant due to concerns about the nature of the organization. There was fear that the property might be used for walk-in services or create disruption to other tenants.

I took the time to coordinate a meeting with all parties, including the landlord’s broker, and presented a clearer, more accurate picture of the tenant’s intent. We explained in detail that the space would be used exclusively for administrative office work. This reduced the landlord’s anxiety, built trust, and ultimately led to a finalized lease that might not have happened without that extra step of communication and clarity.

Reliability Beats High Price

On the sales side, I represented a buyer interested in an industrial property that had already received several offers. The seller was frustrated because previous buyers had over-promised and under-delivered—canceling due to financing delays or failing to meet contingency deadlines.

I worked closely with my buyer to ensure the offer was solid, with clear terms, a strong financial package, and a realistic timeline. I also communicated consistently with the seller’s agent to keep them informed at every stage. Because I addressed the seller’s priorities directly and followed through with professional documentation and steady updates, our offer stood out as dependable and well-structured. We ultimately secured the deal, even though our offer wasn’t the highest.

In both situations, the key was staying engaged, addressing concerns early, and presenting well-prepared clients. Whether it’s a lease or a purchase, understanding the other party’s goals and removing uncertainty goes a long way in getting offers accepted—especially in competitive or sensitive scenarios.

Buying Commercial Real Estate: How To Negotiate Effectively

1. Consider your needs

When you’re looking to buy commercial real estate, there are a lot of factors that go into the decision-making process. What’s the current market value? Is it in a good location? What kind of potential do you see in this property? How much can you afford? Pay close attention to these questions.

But before you start looking at numbers and locations, think about what will make your business thrive. What are your goals for this property? Do you want it to be an office space for employees? Or could it be a retail space for customers? Maybe it could be both! If you know exactly what you’re looking for, then it’ll be easier for you to find the right place.

2. Plan your budget

Before you start looking at properties, it’s important to have a budget in mind. You don’t want to fall in love with a place that’s way out of your price range—but then again, sometimes you just can’t help yourself! When you visit a potential property, take note of what amenities are available and how much they cost. This will help you determine whether or not the property is financially viable for your business.

3. Find a good advisor

If you don’t have experience looking at real estate, it’s a good idea to enlist the help of an expert in commercial real estate. An experienced advisor can help you find a property that will meet your needs, as well as negotiate on your behalf. This is especially important if you’re buying property for the first time—you want someone who knows what they’re doing.

4. Conduct a thorough due diligence

As a property owner or a future property owner, it’s important to take your time and perform a due diligence process on any property before you commit to buying. By taking the time to go through all the records, check for zoning restrictions, and investigate any potential issues with the property, you can rest easy knowing that when you sign that contract, you’re going into it fully aware of what lies ahead. This is an essential step in becoming a property owner – one that should never be overlooked!

5. Make an effective offer

Offers are an important part of commercial real estate transactions. They’re what you use to indicate how much you’re willing to pay for a property, as well as any other terms and conditions that might be important to you (such as the closing date). Your offer should be written in a clear and concise manner so that it doesn’t leave any room for ambiguity or confusion.

The Biggest Mistakes I See in Commercial Real Estate Offers

One of the biggest mistakes people make when putting together an offer—on either side of the transaction—is not being realistic or collaborative about the deal terms.

Common Buyer Mistakes

On the sales side, buyers often frustrate sellers by:

- Submitting vague offers

- Asking for long contingency periods

- Offering aggressive low prices

- Coming in with minimal down payments

These offers can feel unserious or risky, especially when sellers are looking for commitment and certainty.

When Sellers Sabotage Their Own Deals

But sellers can also derail deals by being overly aggressive—expecting prices well above listing, refusing to make any repairs or improvements, and declining to warrant the condition of major building systems like HVAC, plumbing, or electrical. That level of rigidity can make even qualified buyers walk away.

Leasing Pitfalls

In leasing, tenants often hurt their chances by submitting offers with unrealistically low rental rates, requesting large tenant improvement allowances without proper justification, or proposing short-term leases with too many conditions. Landlords, on the other hand, may insist on top-of-market rents without investing in basic upgrades or building out the space to attract quality tenants.

Whether it’s a lease or a sale, the most successful deals happen when both parties understand the market, listen to each other’s needs, and show some flexibility. Deals tend to fall apart when one side—buyer, seller, tenant, or landlord—digs in without considering the bigger picture. A realistic, well-prepared offer and a willingness to collaborate are key to getting the deal done.

My Strategic Approach to Pricing Commercial Property Offers

When deciding what price to offer—or accept—on a commercial property, it depends on whether I’m advising a buyer, seller, landlord, or tenant. Each has a different motivation, and part of my job as a broker is helping them price realistically and strategically.

For Buyers: Data-Driven Decisions

For buyers, the offer price is driven by market comps, the property’s income potential, current condition, and any value-add opportunities. I’ll evaluate cap rates, tenant stability, lease terms, and potential future upside. For owner-users, it’s more about how the property fits their operational needs, financing options, and how it compares to other available spaces.

For Sellers: Managing Expectations

Sellers, on the other hand, often come in emotionally or financially tied to a target price—sometimes higher than the market will support. I walk them through sales comps, income data, and buyer expectations to help them understand where pricing needs to be to generate real interest. One common challenge is sellers expecting top dollar without making improvements or offering any warranties on major systems. That can backfire unless the property has a unique or irreplaceable feature.

Balancing Landlord and Tenant Interests

Landlords face a similar challenge when pricing leases. They may want premium rent, but if the space isn’t turnkey or the market is soft, it requires concessions or a tenant improvement allowance to stay competitive. I help them balance rent expectations with what will actually fill the space and reduce downtime.

Tenants, meanwhile, are focused on total occupancy cost and flexibility. They often prioritize location and layout, but price plays a huge role—especially with NNN expenses or needed build-outs. I help them craft an offer that reflects current lease comps while negotiating for favorable terms, like free rent, build-out help, or renewal options.

Across all scenarios, success comes down to data, positioning, and communication. Offers that are too aggressive—whether from buyers or sellers—tend to stall deals. Offers that are thoughtful, backed by facts, and aligned with current market conditions are the ones that move forward. My role is to guide clients toward the price and terms that achieve their goals and get the deal done.

Things You Need Before Making an Offer

Before you close the deal

It’s important to do your due diligence period. To achieve this, it is common practice to request the seller’s most recent tax returns, utility bills, and a summary of maintenance and renovation work done on the property (going back five years, typically).

You should also inquire about any recent environmental evaluations performed by the vendor to confirm the absence of site contamination or hazardous building materials. Inquire whether or not the assessor has been approved by your financial institution. If it does not, your bank may demand a second opinion from a qualified professional. If no up-to-date, credible evaluation is available, you can always commission one yourself.

Environmental concerns are among the most common issues found during investigations. “They can have an impact on worker health, the building’s marketability, and the appeal to get financing from a bank.”

Also, during due diligence, you should receive an assessment of the building’s condition (the business equivalent of a home inspection), an appraisal (particularly for larger properties), and a title search.

For instance, even if the parking lot isn’t officially recorded as invading neighboring property, a title search may reveal this fact.

You can either change your mind about the acquisition or negotiate a lower commercial real estate purchase price if problems are found during due diligence.

Be respectful of all parties

When you’re buying a building, you represent not only yourself but also the entity that’s financing your purchase. It’s important to conduct yourself with respect and integrity at all times, whether you’re negotiating with the seller or dealing with other parties involved in the transaction (such as lawyers).

Beyond Price: Terms That Actually Win Deals

Price matters, but it’s often the other terms that seal the deal—especially in competitive markets. When representing a buyer or tenant, I’ve found that sellers and landlords pay close attention to the structure and certainty of an offer.

Terms That Make Offers Irresistible

Some of the most attractive terms beyond price include:

- Shorter contingency periods – When buyers keep due diligence, financing, or appraisal timelines tight, it shows confidence and reduces uncertainty for the seller.

- Larger earnest money deposits – A higher deposit signals serious intent and gives the seller more assurance that the buyer won’t walk away easily.

- Fewer contingencies – Removing or limiting conditions (like sale-of-other-property or overly complex inspection clauses) simplifies the path to closing.

- All-cash or pre-approved financing – Certainty of funds is huge. An offer backed by proof of funds or a lender letter stands out from less prepared buyers.

- Quick close or flexible timing – If a buyer can close on the seller’s timeline—whether fast or delayed to accommodate their move-out or 1031 exchange—that flexibility can outweigh a slightly higher offer.

- “As-is” terms or limited repair requests – Especially with older or industrial properties, sellers appreciate buyers who won’t nickel-and-dime over minor issues or request large credits for improvements.

- Tenant intent and use clarity (in leases) – In leasing scenarios, landlords want to know how the space will be used, how financially stable the tenant is, and if they’ll be low-maintenance. A well-prepared package—including business plan, financials, and timeline—makes a big difference.

Ultimately, sellers want certainty, speed, and confidence. I always advise my clients to look beyond just price and ask: What matters most to the other side? Structuring the right offer is part strategy, part psychology—and that’s where experience really counts.

When Unconventional Strategies Win: A Real Success Story

In my experience as a commercial broker, I once represented a seller who received multiple offers on their property, including one with a higher price. However, I trusted my gut and advised the seller to choose a slightly lower offer from a buyer who clearly demonstrated readiness and professionalism.

This buyer showed up prepared with a team of contractors for quick inspections, was punctual for every appointment, didn’t push for unnecessary price credits or discounts, and efficiently secured all required permits on time.

The seller valued this reliability and momentum—knowing the buyer was serious and wouldn’t cause delays made their offer far more attractive than the higher but less certain bids.

This situation reinforced for me how important it is to trust experience and intuition. A buyer’s readiness and commitment can be just as crucial as price when deciding which offer to accept.

How to make an offer on commercial real estate

Here are some ideas on how to make an offer:

Letter of Intent

In many different sorts of deals, including commercial real estate deals, a letter of intent (or LOI) is a crucial document. Indicative of the parties’ seriousness in proceeding with a real estate purchase is the use of such non-binding agreements.

Consistent documentation of an agreement’s terms is crucial, which is why letters of intent are so useful. They also aid in making complex negotiations more understandable and manageable. In commercial real estate, an LOI can serve as a protective measure for both parties as they work toward finalizing a more binding agreement.

Although a letter of intent cannot be legally enforced on its own, it may include provisions that would if included in a formal purchase contract, such as a promise to keep information confidential or to negotiate in good faith. That’s how they’re like an MOU or a term sheet (MoU). Contrary to term sheets, the information in an LOI is always presented in letter format.

Purchase and Sale Agreement

A purchase and sale agreement is a legally binding contract that outlines the terms of a commercial real estate transaction. It contains all relevant information about the parties involved, including their names and addresses, as well as details about the property itself.

Attorney Review

Purchasing or selling a property can be an exciting and important step. To safely move forward, it is critical that you invest in legal protection and have the purchase and sale agreement reviewed by an attorney. Expert legal review can detect any legal issues that could void the agreement, avoiding costly legal fees down the line. Don’t skip this crucial step on your journey – make sure to have an attorney check over the agreement before signing!

Accountant Review

Broker Brochure

Brochures or flyers should be made in a way that grabs people’s attention and gives them a quick overview of the listing. Flyers are short, uncomplicated documents that include demographic data, a summary of the offering, a description of the property, and a few highlights.

Seller Financials

The seller’s financials should include a business plan, cash flow statement, and balance sheet. These documents can help the buyer evaluate the seller’s financial position, determine whether the asking price is fair, and decide whether to proceed with closing.

Performa

For each given asset, the performa is the ideal case scenario. The performa is included in the broker brochure, but you need still to do your own research and come up with your own numbers. Find out where you think the rents could go, and if there are any costs you can cut.

Your Numbers

The final step is compiling data and statistics from your research and objectives.

Financing Your Commercial Real Estate Purchase

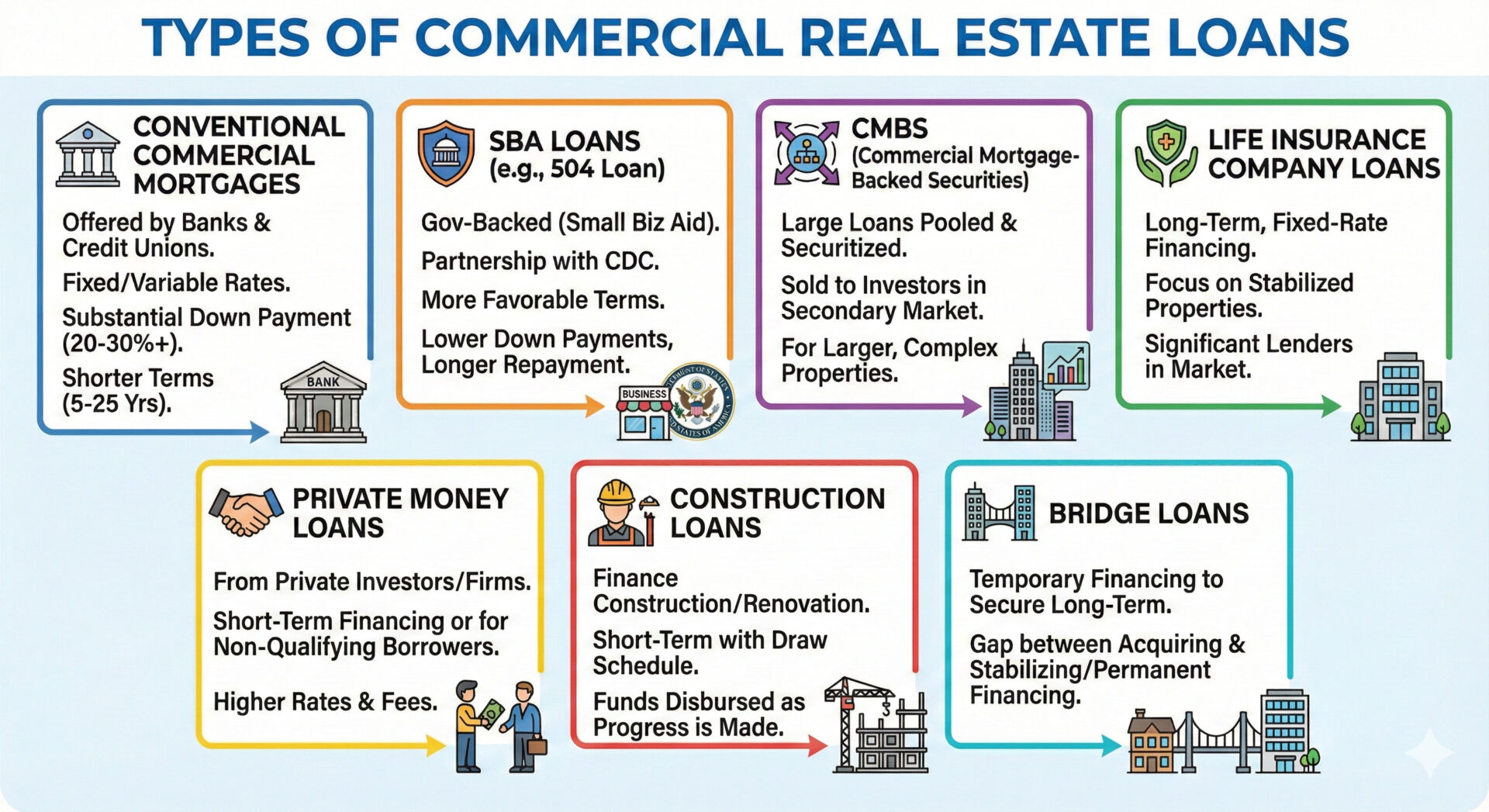

Financing commercial real estate is a critical step in the acquisition process. Unlike residential mortgages, commercial loans are often more complex and require a deeper understanding of various financing options. Here’s a breakdown:

Types of Commercial Real Estate Loans:

Conventional Commercial Mortgages: These are offered by banks, credit unions, and other financial institutions. They typically have fixed or variable interest rates and require a substantial down payment (often 20-30% or more). Loan terms are usually shorter than residential mortgages (5-25 years).

SBA Loans (Small Business Administration): These government-backed loans are designed to help small businesses purchase commercial real estate. The most common SBA loan for real estate is the 504 loan, which involves a partnership with a Certified Development Company (CDC). SBA loans often offer more favorable terms, such as lower down payments and longer repayment periods.

CMBS (Commercial Mortgage-Backed Securities): These are large loans that are pooled together and securitized, then sold to investors in the secondary market. CMBS loans are typically used for larger, more complex commercial properties.

Life Insurance Company Loans: Life insurance companies are significant lenders in the commercial real estate market, often providing long-term, fixed-rate financing for stabilized properties.

Private Money Loans: These loans come from private investors or firms and are typically used for short-term financing or for borrowers who can’t qualify for traditional loans. They usually come with higher interest rates and fees.

Construction Loans: These loans finance the construction or renovation of commercial properties. They are typically short-term and involve a draw schedule, where funds are disbursed as construction progresses.

Bridge Loans: Bridge loans provide temporary financing while a borrower secures long-term financing. They are often used to bridge the gap between acquiring property and stabilizing it or securing permanent financing.

Key Loan Terms:

Loan-to-Value (LTV): The ratio of the loan amount to the appraised value of the property.

Debt Service Coverage Ratio (DSCR): A measure of the property’s ability to generate enough income to cover its debt payments.

Interest Rate: This can be fixed, variable, or tied to a benchmark rate.

Loan Term: The length of the loan.

Amortization: The process of paying down the loan over time.

Prepayment Penalty: A fee charged if the borrower pays off the loan early.

Choosing the Right Financing:

The best financing option for your commercial real estate purchase will depend on several factors, including the type of property, your financial situation, your creditworthiness, and your investment goals. It’s crucial to shop around and compare offers from different lenders to find the most favorable terms.

Calculating ROI and Other Key Metrics

Understanding the financial performance of a commercial property is essential for making informed investment decisions. Here are some key metrics:

Net Operating Income (NOI): This is the property’s income after paying all operating expenses, excluding debt service (mortgage payments). NOI = Gross Income – Operating Expenses.

Capitalization Rate (Cap Rate): This is the rate of return on a real estate investment, calculated as NOI / Property Value. It represents the potential annual return if the property were purchased with all cash.

Return on Investment (ROI): This measures the profitability of an investment as a percentage. ROI = (Net Profit / Cost of Investment) x 100.

Cash Flow: This is the cash generated by the property after paying all expenses, including debt service. Positive cash flow is crucial for long-term success.

Internal Rate of Return (IRR): This is the discount rate that makes the net present value of all cash flows from a particular investment equal to zero. It’s a more sophisticated measure of return than ROI, taking into account the time value of money.

| Metric | Formula | Description | Key Considerations |

| Net Operating Income (NOI) | Gross Income – Operating Expenses | The property’s income after all operating expenses but before debt service | • Excludes mortgage payments• Key indicator of property’s operational performance• Used to calculate other metrics like Cap Rate |

| Capitalization Rate (Cap Rate) | NOI / Property Value | The unlevered (no debt) rate of return on a real estate investment | • Higher rates typically indicate higher risk• Useful for comparing different properties• Market-specific metric that varies by location and property type |

| Return on Investment (ROI) | (Net Profit / Cost of Investment) × 100 | Basic measure of investment profitability expressed as a percentage | • Simple but effective metric• Doesn’t account for time value of money• Good for quick comparisons |

| Cash Flow | Net Income – Debt Service | Actual cash generated after all expenses including mortgage payments | • Critical for ongoing property operations• Positive cash flow essential for sustainability• Affected by financing terms and debt structure |

| Internal Rate of Return (IRR) | NPV of all cash flows = 0 | Discount rate that makes the net present value of all cash flows equal zero | • Considers time value of money• More complex but more accurate• Useful for comparing investments with different holding periods |

Important Notes:

These metrics should be used in combination, not in isolation, for comprehensive investment analysis

Local market conditions and property type significantly impact these metrics

Historical performance doesn’t guarantee future results

Regular monitoring and updating of these metrics is essential for property management

How These Metrics Are Used:

- Evaluating Investment Opportunities: These metrics help you compare different investment opportunities and choose the most promising ones.

- Determining Property Value: Cap rate is often used to estimate the value of a commercial property.

- Assessing Financial Performance: Tracking these metrics over time helps you monitor the financial health of your investment.

- Making Investment Decisions: These metrics inform your decisions about buying, selling, or holding onto a property.

Tax Implications of Commercial Real Estate Investment

Commercial real estate investments come with various tax implications that can significantly impact your returns. Understanding these implications is crucial:

- Depreciation: The IRS allows you to deduct a portion of the building’s value each year as depreciation, which reduces your taxable income. Commercial buildings are typically depreciated over 39 years.

- Deductions: You can deduct various expenses related to your commercial property, such as mortgage interest, property taxes, insurance, repairs, and maintenance.

- 1031 Exchange: This allows you to defer capital gains taxes when you sell one investment property and reinvest the proceeds into another “like-kind” property. It’s a powerful tool for building wealth through real estate.

- Capital Gains Taxes: When you sell a commercial property, you may have to pay capital gains taxes on the profit you make. The tax rate depends on how long you held the property (short-term vs. long-term).

Understanding Commercial Real Estate Leases

Commercial real estate leases are complex legal agreements that define the relationship between the landlord and the tenant. Understanding the different lease types and key lease terms is essential for both landlords and tenants.

Types of Commercial Leases:

- Triple Net Lease (NNN): The tenant pays rent, property taxes, insurance, and maintenance expenses. This is the most common type of commercial lease.

- Double Net Lease (NN): The tenant pays rent, property taxes, and insurance. The landlord is responsible for maintenance.

- Single Net Lease (N): The tenant pays rent and property taxes. The landlord is responsible for insurance and maintenance.

- Gross Lease: The tenant pays a fixed rent, and the landlord pays all operating expenses.

- Percentage Lease: The tenant pays a base rent plus a percentage of their gross sales. This is common in retail spaces.

Key Lease Terms:

- Lease Term: The length of the lease.

- Rent: The amount of rent the tenant pays.

- Rent Escalations: How and when rent increases over the lease term.

- Tenant Improvements (TI): Improvements made to the space by the tenant, often with landlord contributions.

- Options to Renew: Whether the tenant has the option to renew the lease at the end of the term.

- CAM (Common Area Maintenance): Charges for maintaining common areas, like hallways and parking lots.

Lease Negotiations:

Lease negotiations are a critical part of the commercial real estate process. Both landlords and tenants should be prepared to negotiate favorable terms. It’s often advisable to have a real estate attorney review the lease before signing.

The Importance of Working with an Experienced Commercial Real Estate Agent

Making an offer on a commercial property can be a complex and challenging process, with many potential pitfalls along the way.

That’s why it’s crucial to have an experienced commercial real estate agent by your side. A knowledgeable agent can provide invaluable guidance and support throughout the entire process, from identifying suitable properties to negotiating terms and closing the deal.

One key benefit of working with a seasoned agent is their deep understanding of the local market. They can provide insights into pricing trends, demand drivers, and potential opportunities that may not be apparent to the untrained eye. This market knowledge can help buyers make informed decisions and avoid overpaying for a property.

In addition, experienced agents often have access to a wide network of industry contacts, including other brokers, property owners, and potential sellers. This network can be a valuable source of off-market opportunities that may not be available to the general public. By tapping into these hidden gems, buyers can potentially secure a property at a more favorable price or with better terms.

Perhaps most importantly, a skilled agent can provide critical support during the negotiation process. They can help buyers craft a strong offer that balances their needs and goals with the realities of the market. They can also advise on key considerations like due diligence contingencies, closing timelines, and specific requirements or concessions that may be appropriate for the situation.

Of course, not all commercial real estate agents are created equal. It’s important to work with someone who has a proven track record of success and a deep commitment to client satisfaction. Look for an agent with extensive experience in the specific type of property you’re interested in, as well as a reputation for integrity and professionalism.

When you find the right agent, they can be an invaluable partner in your commercial real estate journey. They can help you navigate the complexities of the process, avoid costly mistakes, and ultimately achieve your goals. So if you’re considering making an offer on a commercial property, don’t go it alone. Partner with an experienced agent and leverage their expertise to help you succeed.

Understanding the Seller’s Motivations: The Key to Crafting a Winning Offer

When you’re making an offer on a commercial property lease or looking to purchase outright, it’s easy to get caught up in your own goals and priorities. After all, you’ve got a business to run and a bottom line to think about. But here’s the thing: if you want your offer to stand out from the rest, you need to put yourself in the seller’s shoes.

Think about it – every seller has their own unique set of motivations and priorities. Some might be looking for a quick closing so they can move on to their next venture. Others might have a specific price target in mind, based on their own financial goals or market analysis. And still others might be more concerned with maintaining confidentiality throughout the process, for whatever reason.

The point is, if you can tap into those motivations and show the seller that you understand where they’re coming from, you’ll be in a much stronger position to craft an offer that resonates with them. So how do you do that?

Start by doing your homework. Talk to your real estate agent about what they know about the seller’s situation. Look for clues in the property listing or marketing materials. If you have the opportunity to meet the seller in person, pay attention to the questions they ask and the concerns they raise.

Once you have a sense of what’s driving the seller, you can start tailoring your offer to meet their needs. For example, if you know they’re looking for a quick closing, you might offer to waive certain contingencies or accelerate your due diligence process.

If they’re focused on price, you might look for ways to sweeten the deal with non-monetary incentives, like a leaseback arrangement or favorable financing terms.

The key is to be creative and flexible in your approach. Don’t just put together a generic offer and hope for the best. Take the time to really understand what the seller wants, and then craft an offer that shows them you’re the buyer who can make it happen.

Of course, this doesn’t mean you should ignore your own interests entirely. You still need to make sure the deal makes sense for your business and your bottom line. But by taking the seller’s perspective into account, you’ll be in a much better position to find a win-win solution that works for everyone involved.

So the next time you’re getting ready to make an offer on a commercial property, don’t just focus on your own needs and wants. Take a step back and try to see the deal through the seller’s eyes. It might just be the key to unlocking a successful transaction and a profitable investment for your business.

| Aspect | Description | Importance |

| Understanding Seller Motivations | Crucial for crafting an offer that resonates with their needs and priorities | Can make the difference between accepted and rejected offers |

| Common Seller Motivations | 1. Quick closing 2. Specific price target 3. Maintaining confidentiality | Knowing these helps you structure competitive offers |

| How to Gain Insight | 1. Consult with your real estate agent 2. Look for clues in property listings or marketing materials 3. Pay attention to the seller’s questions and concerns during meetings | Better intelligence leads to more strategic offers |

| Tailoring Your Offer | 1. Waive contingencies or accelerate due diligence for a quick closing 2. Offer non-monetary incentives for price-focused sellers 3. Be creative and flexible in your approach | Customized offers stand out in competitive markets |

| Balancing Interests | While considering the seller’s perspective, ensure the deal still aligns with your business goals and bottom line | Protects your investment while winning the deal |

FAQs

What should be included in a commercial offer?

Income.

Expenses.

Mortgage.

Cashflow.

Payment and Refund in Cash.

The yield on Capital.

Investment Costs.0

What is a 1031 Exchange?

How do you pitch a commercial real estate?

How do you prospect for commercial real estate clients?

How do you pitch a commercial idea?

Conclusion

Look, commercial real estate doesn’t have to be overwhelming. After years of helping clients navigate these deals, I’ve seen that success comes down to preparation, clear communication, and understanding what really matters to the other side.

Every property and every deal is different, which is why having someone in your corner who knows the market makes all the difference. If you’re ready to make your next move or just want to explore your options, I’d love to chat about your goals.

Ready to get started? Schedule a consultation with me today and let’s turn your commercial real estate vision into reality.