Are you a student looking to invest in your future through student housing—or perhaps you know someone who is? Today, with rising tuition costs and an increasingly competitive job market after graduation, making smart investments in the right places now can make all the difference. Student housing investments provide both financial returns and personal benefits, allowing college students to maximize their academic potential while reducing their long-term debt burden.

In this blog post, we’ll discuss why investing in student housing may be the perfect way for students to save money and improve their independence during their college years. We’ll also offer guidance on how to make constructive decisions when selecting investment properties. Whether you are just starting or a pro-investor wanting a refresher –– this post has something for everyone interested in taking charge of their higher education finances!

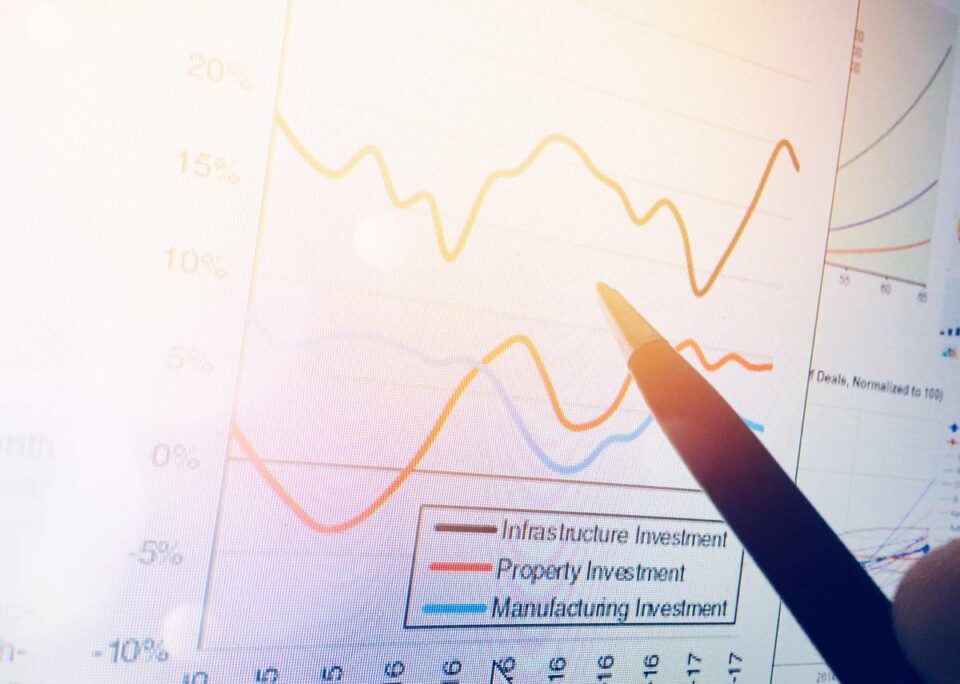

Recent data from CBRE reveals a significant surge in annual student investment volume, which has tripled since 2014, reaching a staggering $11 billion in 2018. This remarkable growth can be attributed to the continuous rise in college enrollment, coupled with limited supply. The sustained investment activity underscores the immense potential and attractiveness of this student housing market.

Key Takeaways

- Student housing, due to perennial university enrollments, offers a predictable and stable demand, making it a solid hedge against market uncertainties in the CRE sector.

- Compared to other real estate sectors, the student housing sector often promises higher returns, making it a lucrative option for those aiming to optimize their portfolio yields.

- To navigate the ever-fluctuating CRE market, diversifying by including student housing investments can offer enhanced protection against potential downturns.

Table of Contents

The Background

Student housing, often characterized by off-campus apartments, dormitories, and purpose-built student accommodations, has emerged as a significant niche within the Commercial Real Estate (CRE) market. Its history is intricately woven into the fabric of evolving higher education trends, urban development, and changing student demographics.

Traditionally, the demand for student housing was met primarily by on-campus dormitories. However, as universities expanded and faced budget constraints, coupled with growing student populations, the demand for off-campus accommodations rose. This paved the way for private investors and developers to recognize the potential of catering to this ever-growing market segment.

As early as the late 20th century, astute investors began to notice the counter-cyclical nature of student housing. For example, during economic downturns, while other real estate sectors such as retail or office spaces may falter due to reduced consumer spending or business downsizing, student housing often remained stable or even saw increased demand. This is primarily because people tend to pursue higher education during economic recessions, hoping to improve their qualifications and job prospects.

However, the real momentum in student housing investments picked up in the early 21st century. As global mobility increased, so did the number of international students seeking quality education in prestigious institutions worldwide. For instance, a student from India or China might travel to the US or UK for higher education. Such students, unfamiliar with the local housing market and often without a local guardian, became a lucrative target audience for purpose-built student accommodations.

Recent Economic Shifts and the Need for Portfolio Diversification

The world has witnessed a series of profound economic shifts in recent years. From the global financial crisis of 2008 to uncertainties stemming from trade wars, Brexit, and more recently, the COVID-19 pandemic, the need for robust portfolio diversification has never been more pronounced.

To put this into perspective, consider a hypothetical investor, Jane. Jane had her investment primarily in retail spaces. However, with the rise of e-commerce and the socio-economic repercussions of the pandemic, traditional brick-and-mortar retail saw a decline. Had Jane diversified her portfolio to include student housing, she might have experienced a buffer against the declining returns from her retail investments. This is because, during such times, while people might cut back on luxury spending, the quest for education often remains undeterred.

Moreover, the digital transformation wave, primarily driven by the tech boom and subsequent rise in remote working and learning trends, has reshaped the CRE market dynamics. However, even with increased online learning options, the allure of campus life, networking, and holistic educational experiences ensures a continued demand for physical student accommodations.

In essence, including student housing in an investment portfolio offers a hedge against potential downturns in other CRE sectors. Its relatively consistent demand, driven by annual student enrollment cycles and a seemingly insatiable global appetite for quality education, makes it a lucrative addition for investors seeking both stability and growth.

As the landscape of the CRE market continues to evolve, buoyed by global economic shifts and changing consumer behaviors, student housing stands out as a resilient and promising investment avenue. It not only echoes the evergreen nature of education but also offers investors a chance to fortify their portfolios against unpredictable economic tides.

The Unique Benefits of Student Housing Investments:

Student housing investments present a distinctive set of advantages compared to traditional real estate investments. These advantages are predominantly due to the peculiar dynamics of the higher education sector and the consistent requirements of students. Let’s delve deeper into these benefits:

Predictable Demand Due to Consistent University Enrollments:

- Explanation: The demand for off-campus student housing largely hinges on university enrollments, which tend to remain relatively stable year over year. Unlike other sectors where demand can fluctuate drastically due to economic or market conditions, the education sector often sees a steady stream of students seeking accommodation each year.

- Example: Consider a city that houses a renowned university. Every year, this university admits a certain number of students, many of whom are from out-of-town or international locales that are looking for college towns. These students will always require a place to stay, ensuring a consistent need for student housing.

Resilience During Economic Downturns:

- Explanation: Historically, student housing has proven to be resilient during economic downturns. This is partly because, during challenging economic times, many individuals choose to go back to school to enhance their skills, resulting in increased enrollments. Moreover, education is often viewed as a non-discretionary expense, meaning families prioritize spending on it even in tougher times.

- Example: In the aftermath of the 2008 economic crisis, while many sectors saw decreased demand, universities and colleges witnessed an uptick in enrollments as many sought refuge in education to navigate a challenging job market. As a result, student housing remained in high demand, offering a buffer against the turbulent real estate market.

Higher Returns than Traditional Real Estate Investments:

- Explanation: Student housing often offers higher returns compared to traditional real estate because of the unique rental structures in place. Typically, students rent by the bed rather than by the unit. This means that a single apartment or house, when divided appropriately, can generate multiple streams of income. Additionally, the consistent and predictable demand, as discussed earlier, ensures occupancy rates remain high.

- Example: Imagine a traditional three-bedroom apartment. In a conventional rental scenario, this might be rented out to a single family or a group of friends. However, in a student housing scenario, each bedroom could potentially be rented out to a different student. Furthermore, shared living spaces might also be used to accommodate more students. As a result, the total rental income from this single unit becomes significantly higher than its traditional counterpart.

Student housing investments offer a unique blend of stability and profitability. They benefit from the predictable and resilient nature of university enrollments, making them an attractive proposition for investors looking to diversify their portfolios and seek higher returns in a dependable sector.

Make sure you don’t miss out on reading an article I wrote, “Elevate Your Earnings: Increase Your Commercial Property Value,” packed with valuable insights to help you level up!

Comparative Analysis:

Performance

Student Housing:

- Stability: Student housing is often regarded as recession-resistant. Even during economic downturns, people continue to attend universities and require housing. This creates a steady demand, leading to relatively stable rental income. A 2018 study by CBRE reported that occupancy rates for student housing properties remained consistent even during the 2008 financial crisis.

- Yield: Owing to its niche nature, student housing often offers higher rental yields than other real estate sectors. Investors can charge per bed rather than per unit, maximizing revenue from each property.

- Market Dynamics: Universities, especially in growth markets, are consistently expanding, ensuring an ongoing market for student accommodations.

Traditional Residential Real Estate

- Flexibility: Unlike student housing that caters primarily to a seasonal and specific demographic, traditional housing has a broader tenant base, offering flexibility in terms of lease terms and tenant types.

- Capital Growth: In well-chosen markets, traditional real estate can appreciate significantly over time, offering investors both rental income and capital gains.

- Maintenance: Typically, traditional housing can have lower turnover rates and less wear and tear, as it doesn’t cater to the student demographic that changes yearly.

Commercial Real Estate

- Lease Terms: Commercial leases tend to be longer in duration (often multiple years) compared to the yearly or semester-based contracts in student housing.

- Dependence on Economic Health: The success of commercial properties is largely tied to the health of the economy. A downturn can lead to business closures and subsequently vacant properties.

Case Studies Showcasing Successful Student Housing Investments

Case Study 1: Austin, Texas

Austin, with its prominent University of Texas campus, saw a surge in student population but limited on-campus accommodations. Investors noted this gap and began developing purpose-built student accommodations. By focusing on amenities students wanted – high-speed internet, study rooms, gyms, and proximity to campus – these properties saw high occupancy rates and generated significant returns.

Case Study 2: Exeter, UK

In Exeter, a historic university town in the UK, private investors collaborated with the university for a win-win deal. Recognizing the consistent growth of the university and its international appeal, investors developed high-quality student accommodations, securing long-term leases with the university. This not only ensured guaranteed occupancy but also reduced the need for individual marketing and maintenance, leading to substantial profit margins.

Concluding Thoughts:

When investing in real estate, it’s essential to understand the nuances of each sector. While student housing presents a compelling case with its consistent demand, high yields, and relative recession resistance, it’s not without its challenges, such as higher turnover and seasonal vacancies. Still, as showcased by successful investments in cities like Austin and Exeter, with the right strategy and understanding of the market, student housing can indeed be a lucrative venture in the real estate portfolio.

Strategies for CRE Investors

Identifying Prime Student Housing Investment Opportunities

Student housing has traditionally been a resilient segment of the CRE market due to the constant demand generated by universities and colleges. To identify prime opportunities, consider the following:

- Research Universities with Growing Enrollments: Regularly look into institutions with steadily increasing student numbers. A college or university with a rising enrollment often signifies a growing demand for off-campus housing. For instance, if State University A has reported a 10% increase in student enrollment year over year, there’s a potential rise in demand for nearby student accommodations.

- Evaluate Location Proximity: Prime student housing properties are usually within walking distance or a short commute to the campus. Consider a scenario: If there are two properties, Property X is a 5-minute walk from the main academic buildings while Property Y is a 30-minute drive away, Property X would likely be more appealing to students and command higher rents.

- Understand Amenities and Preferences: The modern student often looks for amenities such as Wi-Fi, study rooms, gyms, and communal spaces. For example, if building A offers high-speed Wi-Fi and modern gym facilities while building B doesn’t, building A will naturally be more attractive to tech-savvy students.

- Look for Stable or Improving Local Economies: Areas with robust local economies often see universities expanding programs and attracting more students. If City Z has seen a surge in local businesses and job opportunities, there’s a chance its local institutions will grow, increasing the demand for student housing.

Risk Mitigation Tactics

Risk is inherent in any investment, but for student housing, consider the following tactics:

- Secure Long-Term Leases: To ensure a steady income stream, try to secure longer-term leases. If John, a sophomore, agrees to a 2-year lease, that’s two years of guaranteed rental income for that unit.

- Consider Rent Guarantors: Many students may not have the financial history to qualify for a lease. In these cases, securing a guarantor (often a parent or guardian) ensures someone is accountable for the rent. For example, if Sarah, a freshman, doesn’t have an income but her parents sign as guarantors, you have added security that the rent will be paid.

- Maintain and Upgrade Properties Regularly: A well-maintained property reduces the risk of unexpected repair expenses. Think of it this way: Regularly servicing the HVAC system in Building C might cost a few hundred dollars, but replacing it entirely due to neglect can run into thousands.

- Diversify Across Multiple Institutions: Instead of investing all your funds in housing near one university, consider properties near several institutions. If College D faces a sudden drop in enrollment, having investments near Colleges E, F, and G can buffer against potential losses.

Building a Diversified CRE Portfolio

Diversification is the cornerstone of risk management. For CRE portfolios:

- Geographical Diversification: If you invest solely in one city or region, you’re exposed to local economic downturns. Imagine if all your properties are in City H, which faces an economic crisis. If you had also invested in Cities I and J with booming economies, the latter would offset potential losses in City H.

- Sector Diversification: Apart from student housing, consider investing in other sectors like retail, office spaces, or industrial properties. While student housing might face challenges during an online-learning trend, office spaces or warehouses catering to online businesses might thrive.

- Financial Structuring: Diversify in terms of debt structures and financing methods. Fixed-rate loans offer stability in payments, while variable-rate loans can sometimes provide lower interest costs. By balancing both types, you can take advantage of market conditions and cushion against potential interest rate hikes.

The CRE market, especially student housing, offers a plethora of opportunities for discerning investors. By staying informed, mitigating risks, and diversifying your portfolio, you can navigate this segment with confidence and potential for consistent returns. Remember to always conduct thorough due diligence and consult with professionals in the student housing sector.

Student Housing Investments FAQs

How does student housing fare during economic downturns?

Student housing is usually one of the more recession-resistant segments in commercial real estate. While there may be a market correction or dip in demand, student housing often recovers faster than other property types.

Are there risks associated with student housing investments?

Like any other investment, student housing carries some risks. Examples of common risks include vacancy rates due to changes in university policies or general economic trends. To mitigate these potential losses, investors should conduct thorough research and build a diversified portfolio.

How do CRE investors identify profitable student housing opportunities?

CRE investors should look for universities with growing enrollments, evaluate the location proximity of potential investments, understand student preferences and amenities, and research stable or improving local economies. Additionally, working with experienced professionals can help identify potential opportunities.

How can an investor start investing in student housing?

To start investing in student housing, the first step is to research the market and potential investments. This means looking at universities with increasing enrollments, understanding their local economies, evaluating student housing property locations and amenities, and other factors. Additionally, investors should also consult their legal and tax advisors. Once all that is done, they can decide which opportunities to pursue.

How does student housing differ from traditional real estate investments?

The key difference between student housing and traditional real estate investments is the tenant base. Student housing typically has an ever-changing population of student tenants, making vacancy rates a potential risk. Additionally, students may have little to no credit history when signing leases, so investors should consider guarantors or other methods for ensuring rent payments.

Conclusion

Investing in student housing has been a viable strategy for many real estate investors, and its unique characteristics allow for greater diversification when approaching the commercial real estate sector.

With unprecedented turbulence in the CRE market due to economic vicissitudes, investing in student housing might prove particularly beneficial, as it allows property owners to enjoy secure demand and reduced volatility over time. Now more than ever, investors are banking on the stability offered by these properties, making it a great choice for those looking to hedge against potential losses.

For those that are interested in this type of investment but don’t know where to begin, consulting with an experienced CRE professional can help get you started toward long-term investment success. If you want to find out more about how student housing investments can be harnessed as part of your portfolio strategy, I invite you to call or schedule a free consultation with me today!