What will the commercial real estate industry look like in 2025? This is a question that many people are asking, and it is hard to say for sure. However, there are some trends that we can expect to see. In this blog post, we will discuss some of the most likely trends and what they could mean for your business. Keep reading to learn more!

The global real estate market is facing transformative changes in how buildings will be used, valued, and traded in 2025 and beyond as a result of a pandemic-driven course correction. The industry could be even more impacted by the ongoing economic instability in the world. There is a chance for a regional or global recession or stagnation in the near future, and these effects would be felt by all sectors of the financial services industry.

Key Takeaways

- Being large may be more advantageous than ever given the current interest rates and the growing risk of a recession.

- Businesses involved in commercial real estate have a bright future in 2025 because they may take advantage of economies of scale.

- The real estate cycle will be impacted by rising inflation, rising interest rates, and a slowing economy, whether or not the economy continues to contract this year or next. Property owners must start preparing now if they want to invest in and manage assets in a changing climate.

Table of Contents

19 Commercial Real Estate Trends to Watch For in 2025

1. Commercial real estate as a hedge against inflation

The cost of creating new buildings is on the rise, meaning that there are fewer structures available for a lower price.

In the short term, this raises rental prices and property values. Most commercial real estate sectors are designed to include annual rent increases, protecting property owners from inflation-caused cost hikes. For that reason, existing real estate capital markets and assets can be an excellent way to buffer against inflation.

If you’re planning on investing in real estate and you have no idea how it would work out, or what are its pros and cons, I highly suggest reading an article I wrote here, and if you have any further questions, I’ll be glad to answer them! You can read out to me and schedule a free consultation here.

2. Well-funded Players will have access to more opportunities

While the market is splitting into many pieces, 20 years from now institutional investors will still be ahead of smaller firms and wealthy individuals.

With recent interest rates and the increasing likelihood of recession, being big may be more advantageous than ever. Commercial real estate organizations have a promising outlook for 2025 thanks to their ability to capitalize on economies of scale.

Larger institutions could possibly have access to more affordable capital pools. They can also make use of all-cash offers during tough times, which gives them an advantage that their less fortunate counterparts don’t have.

By avoiding high interest rates, powerful institutions can move forward with long-term investment theses without pausing for conditions to improve.

3. Good Year for Multifamily Real Estate

Some of the market forces that spurred the rise in multifamily housing during the epidemic have decreased. Nonetheless, because of the prolonged housing scarcity and high demand for suburban homes, multifamily investors will be able to continue on their current path.

According to CNBC, the home inventory was only half of what it was pre-Covid in June 2022. Several US markets have severe housing unit undersupply due to the under-delivery of new housing, which has been exacerbated over the last ten years. Furthermore, because of increased demand, rents continue to climb, giving investors even more attractive possibilities.

In spite of this, there are a number of factors that will make it difficult for investors to compete in this difficult market. A competitive labor market, for example, increases developers’ complex expenses as the cost of construction materials continues to rise. Moreover, problematic supply chains are delaying the delivery of newly constructed structures and causing developers to have to spend more time bringing them to market.

Multifamily commercial real estate is expected to perform well in 2025, but many opportunities will be available only to those investors who have access to larger pools of capital.

4. Retrades Might Become the Norm

Following 2021’s ideal market conditions, many firms began 2012 with an eye toward achieving robust portfolio performance. Nevertheless, as market conditions have evolved throughout the year, investors are increasingly retrading deals in progress, including those that are nearing completion.

It is possible that deals that were profitable according to early 2022 models may not hold the same terms or interest rates as they once did. This could force firms to reassess equity returns in a completely different light.

The ability to seamlessly compare models that take into account differing conditions will help your firm avoid wasting these valuable resources. It would be possible to eliminate the need for late-stage term adjustments entirely if efficiencies could be built to close deals faster in the first place.

Furthermore, firms that close transactions quickly and more efficiently can also lock in ideal terms before tectonic market shifts threaten the transaction.

5. Growth of Hybrid Work

Hybrid workplaces are on the minds of many organizations as they attempt to determine how to operate during the pandemic. As employee preferences change and various COVID-19 variants emerge, the physical office is becoming increasingly significant. Managers have realized the importance of a hybrid work strategy in promoting products as well as attracting and retaining qualified talent.

There is also an impact of hybrid work on industries that have a deep connection to and investment in the physical workplace. Due to hybrid workplaces, corporate real estate (CRE), in particular, is undergoing a paradigm shift. In the workplace, everything is changing, from the type of physical space, employees prefer to work in, to the amount of square footage needed to accommodate the on-site workforce.

6. Sustainability Movement Impact

The benefits of green real estate extend well beyond the financial aspect. In addition to improving air quality, reducing chronic diseases, and improving people’s health, constructing a more sustainable built environment can reduce carbon emissions by up to 70%. When business steps up to the challenge, communities and wider society can be reassured that businesses act in their long-term interests.

The reasons to invest in real estate far outweigh those who do not. We still have a long way to go before we can quantify the true impact of healthy spaces, carbon emissions, and building value. However, it is clear that if owners fail to manage the risks, asset stranding and brown discounts will become significant.

Real estate will have to play a vital role in a sustainable, just, and equitable future – a net-zero one – over the next decade.

Real estate that fails to keep up with the latest developments in green real estate will become irrelevant. Green premiums will be a temporary addition to a building’s financial performance in the coming years, whereas brown discounts will have a profound impact.

7. Housing costs too much for too many

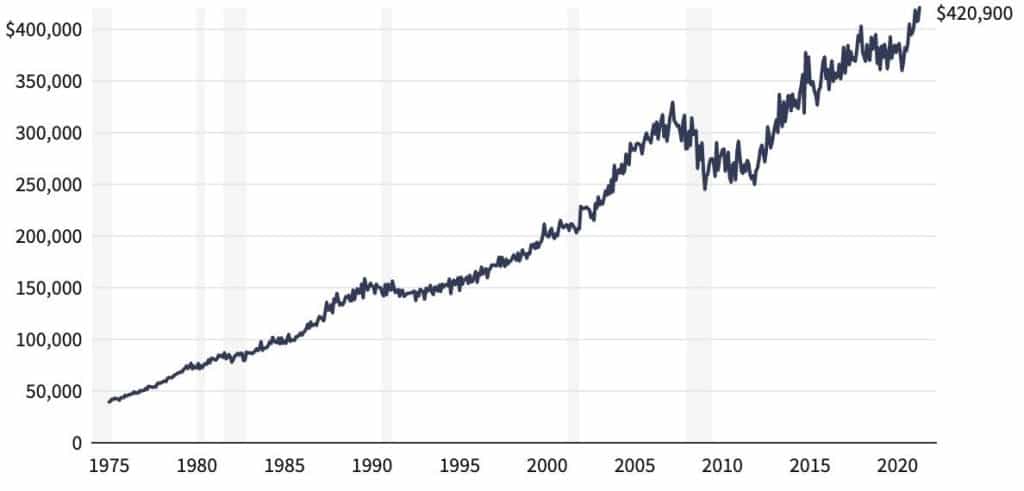

In the years preceding 2007, historical data on housing prices indicated that real estate prices would continue to rise indefinitely. From 1963 until 2007-when the housing bubble burst and the financial crisis of 2008 the average sale price of homes sold in the United States climbed steadily each year.

In the years preceding 2007, historical data on housing prices indicated that real estate prices would continue to rise indefinitely. From 1963 until 2007-when the housing bubble burst and the financial crisis of 2008 the average sale price of homes sold in the United States climbed steadily each year.

Within three years of the financial crisis, the average sales price of homes in the United States had rebounded to pre-crisis levels. Prices rose steadily for the next several years, until 2018 when they flattened. Then, prices fell in 2019. Prices dropped in 2020 but began to rise again in 2021.

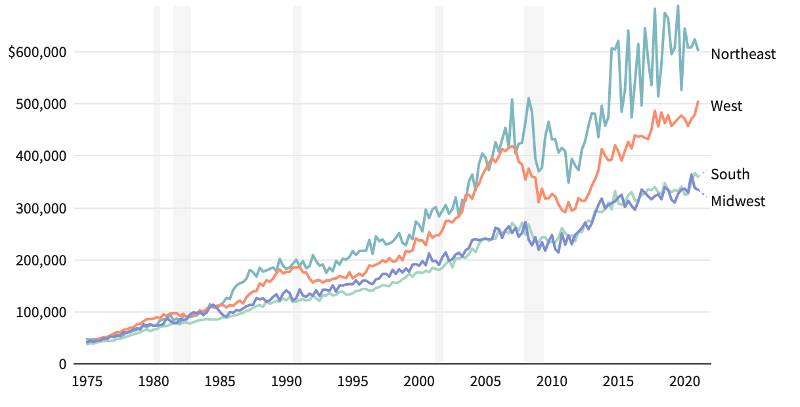

There is no doubt that real estate prices are heavily influenced by the local market and national trends are not a complete picture. When California is experiencing a boom, Detroit may be experiencing a bust.

It is possible for numbers to vary greatly even within the same city. A neighborhood that experiences new growth or gentrification may be experiencing significant price appreciation, while another area across town may be experiencing a decline. Below is a chart that illustrates how the real estate market trends differ in the south, west, northwest, and midwest regions.

You should take into account your local market’s realities when reviewing the national and regional statistics. If your city, state, or neighborhood is experiencing economic decline, rising prices at the national level may not benefit you.

8. Smarter cities through infrastructure spending

Is there a connection between these factors and the real estate market? There is an explosion of growth in the technology sector. This means that developing areas and supporting businesses in this sector will create jobs and attract professionals, resulting in an increase in housing demand.

There will be a similar effect as a result of population growth. In a city with high-paying jobs, excellent public transportation, effective communication with government officials, and modern resident services, who would not want to move there? I would!

In addition, smart cities have lower operating costs, which means that substantial amounts of money can be diverted to other projects, whether they are real estate-related or not.

For developers who use the amenities within the city to market their properties, finding additional resources to invest in the city is always a welcome development. Real estate investors will always be attracted to cities that implement technologies or policies to improve their quality of life.

9. Recession is set to stifle growth

The Federal Reserve is currently debating not only how long inflation will continue and what it will do to combat it, but also whether we will be in or have already entered a recession. A recession has almost always followed periods of monetary tightening, and some leading indicators have fallen to all-time lows, such as the University of Michigan Consumer Confidence Index. The job market remains strong, and consumer spending is strong.

As inflation rises, interest rates rise, and the economy slows down, no matter whether the economy continues to shrink this year or next, the real estate cycle will be impacted. Investing in and operating properties in a changing environment requires property owners to prepare now.

As a result of the current economic climate, real estate investors are experiencing a conundrum. This is because yields may decrease despite the fact that their properties generate significant cash flows.

The majority of markets and properties, except for the office sector, are experiencing continued tenant demand and increasing rents, although at a slower rate than in previous periods.

In a heavily leveraged business, the cost of capital is rising due to the sudden increase in long-term interest rates. Although liquidity continues to provide some cushion, capitalization rates will have to increase. This will result in a decrease in the value of assets.

Investors and operators will have to deal with uncertainty and change until the dust settles and the new variables are incorporated into the computation of yields.

10. Technology is becoming increasingly important in commercial real estate

A working paper on the future impact of technology on commercial real estate was published nearly 20 years ago by the Samuel Zell & Robert Lurie Real Estate Center at Wharton University. There is no doubt that the authors correctly predicted that the growth of technology would adversely affect many retail assets and that the value and demand of commercial real estate would not decrease as a result.

By enhancing property performance and improving tenants’ experience, Internet of Things (IoT) technology is adding value to real estate companies.

It is imperative to note that the Internet of Things is much more than motion-sensor lighting, as described in the Deloitte Center for Financial Services research report. Building management systems are utilizing the Internet of Things (IoT) to enhance the tenant experience and increase the financial performance of commercial real estate investments.

In the future, sensors may be able to convert any object into a source of information. This can be used by property managers and investors to differentiate their services and properties. AI and augmented intelligence technologies are used to enable automated action or influence human decisions for both landlords and tenants. This is done at each stage of an information value loop – acting, creating, and analyzing.

AI, IoT, and machine learning are proving to be beneficial to investors and tenants of all types of commercial real estate. Building owners and property managers who stay abreast of today’s constantly changing technology will continue to add value to their properties. As a result, outdated properties may become obsolete within a short period of time.

11. Leasing will still be hugely popular

According to billionaire Andrew Carnegie, 90% of millionaires are wealthy as a result of their investments in real estate. Do you still believe this to be true? Are real estate investments still wise investments?

They believe the answer to this question is a resounding yes, as evidenced by their million-dollar investments in real estate.

As a real estate professional, you know that leasing is by far the most popular option for commercial tenants. In fact, it’s more than just popular—it’s often the only option for many businesses. That said, there are a few reasons why leasing is so appealing.

First of all, it’s quick and easy.

Leasing a place to do business doesn’t require long-term commitments or huge investments on your part. You can sign a lease and start renting space immediately without having to worry about owning the property down the road or needing to sell it when it comes time to move on.

Second, leasing allows you to remain nimble.

You don’t have to worry about moving your business every few months because you can simply renew your lease if you need more space or move somewhere else if you don’t want to stay where you are anymore.

This makes it easier for companies who don’t want their relocation decisions tied up in ownership issues or long-term agreements with landlords who may not always be willing or able to accommodate them when they need changes made quickly (as can happen with property owners).

12. Impact of tighter regulations

Banks, trust companies, pension funds, credit unions, and insurance companies are the most common institutional lenders for real estate financing. As a general rule, interest rates are either fixed for a specified period of time or are variable, based either on LIBOR or the “prime rate” determined by a lending institution on a periodic basis. Prime rates are calculated based on a lender’s most favored customer’s interest rate.

Usually, the borrower is responsible for paying all legal and other costs associated with arranging a mortgage, including commitment and processing fees. When a loan is secured by real property, an interest rate that is higher upon default is generally not permitted.

Lending institutions usually use primary and collateral assets to secure real estate and related assets. As a general rule, primary security consists of mortgages, trust deeds, or charges, debentures containing fixed charges against real property, or trust deeds that secure mortgage bonds or debentures and include specific charges on real property, when more than one lender is involved.

There are generally three types of collateral security: leases, rents, and general security agreements for personal property.

In the United States, banks and trust companies are regulated by both state and federal laws.

Due to tightening banking regulations and corresponding higher costs, alternative financing arrangements, including real estate investment trusts (REITs), funding, and sale-leaseback arrangements, have become increasingly appealing to property owners.

13. Geopolitical Risk

It can be challenging to measure the direct effects of geopolitical risks on the real estate market. Due to uncertainty regarding the future impact of these risks on economies and financial markets, both global and domestic risks manifest in the form of volatility.

It is difficult to isolate and measure the effects of a conflict such as the conflict in Ukraine, production shutdowns due to elevated COVID infection rates in China, or local politics related to renting regulations, sustainable development, and renovation requirements.

A 40-year high inflation rate and rising interest rates add additional complexity to these risks. There is a blurring of the lines between these risks when you consider the complexities surrounding supply chain stress, an improving but still unresolved pandemic hangover, and energy costs.

The Ukraine-Russia war, as well as the most recent Chinese lockdowns, are the most visible geopolitical risks affecting markets at large.

14. Supply Chain Disruption

We have learned that basic economics is concerned with finding an equilibrium between supply and demand in order to achieve economic harmony. As humans began trading, those whose goods and services were in demand increased production to meet growing demand. In this way, trade and business began.

There are many factors that influence the tug-of-war between supply and demand. They are not all COVID-19 side effects. According to many experts, this started well before COVID-19. The cargo ship “Ever Given” caused a bottleneck in the Suez Canal that backed up cargo ships in Los Angeles.

I have come to the conclusion that this is a global issue, not a U.S. one. Supply chain harmony has become more reliant on others as economies have grown and prospered through increased efficiencies.

Large inventories were held in warehouses in the past. Excess and waste resulted from this old system. Due to increased efficiency and the practice of just-in-time production, warehouses hold less stock.

As e-commerce boomed across the globe after a global pandemic, reserves were not prepared for the rush of demand. The efficiency of Chinese production also became apparent to us. A China shutdown effectively shut down the world.

Disasters caused by weather and climate also contribute. Commercial real estate decisions are now influenced by shortages of wood, steel, computer chips, and electrical supplies. Business in the U.S. is stressed by labor shortages, and commercial real estate is no exception.

Labor shortages have caused 88% of contractors to turn down work and 35% to turn down jobs.

Adapting the process of location decisions is our challenge as commercial real estate practitioners. An unprecedented number of decisions are being driven by site selection. Development schedules are being pushed back several months due to supply chain issues.

Without labor and materials, it risks unmet contractual obligations.

Our expectations are being adjusted due to these challenges if there is an upside. Last-mile warehouses are repurposing vacant retail stores. Leasing opportunities are growing for older buildings. Today’s logistics experts face challenging tasks as they keep up with demand, changing the way products enter ports and the way they are transported.

15. Labor Shortage Pressure

It may be because it affects the industry in multiple ways that the Counselors of Real Estate ranked the labor shortage sixth on their list of top 10 problems for the industry.

Since commercial real estate houses businesses that need workers to run, it is naturally affected by national employment trends. Job openings in the US currently exceed workers to fill them by twice. Every industry is losing workers, but retail, manufacturing, and hospitality have among the highest unemployment rates, with 70%, 45%, and 40% of job openings unfilled. Business struggles affect landlords too.

16. Regulatory Uncertainty

It is not just politics, policies, and priorities that generate regulatory uncertainty at the federal level. This is due to the proliferation of federal regulations addressing land use, real estate, and environmental priorities. These regulations continue to expand in breadth and depth at the administrative level.

As a result of the COVID-19 pandemic, revised regulations were promulgated at all levels of government. Vaccination requirements, mask mandates, and social distancing is among the health and safety regulations aimed at limiting the spread of the disease.

Regulations that provide financial support to the real estate industry during an epidemic directly impact this industry.

17. Cybersecurity Interruptions

Due to decades of technological advancement, we are experiencing a new era of cybersecurity concerns in commercial real estate. In addition to investors, owners, operators, and occupants, there are significant risks associated with the property. The use of for-profit ransomware, nation-state attacks, and underqualified contractors all pose risks to the security of the system.

As Iranian documents have consistently emphasized cybersecurity in their malicious intentions against commercial properties, they have mentioned specific HVAC, lighting, and metering system manufacturers. A number of targets have been identified, including corporate office space like buildings, banks, hospitals, schools, and public places. Several HVAC contractors at Boston Children’s Hospital were ransomed by international hackers

In addition to causing several issues, this can also result in equipment replacement, unauthorized access to corporate networks, and building downtime. Technological advancements for decades, skill shortages, cultural ignorance, savvy bad actors, and an over-dependence on commercial real estate as critical infrastructure have created the perfect storm.

It is generally accepted that investors and owners are able to influence this in the sense that they can direct assessments, policy implementation, and active monitoring downstream to asset managers and property managers.

18. Changes by ESG requirements

In an effort to regulate real estate assets’ performance and transparency, governments all over the world are passing laws, regulations, and ordinances related to environmental, social, and governance (ESG).

By complying with these laws, real estate investors have to measure, report, and, in some cases, disclose their holdings’ environmental footprints. These footprints include energy and water use, waste, carbon emissions, and climate change risks. There is no doubt that these rapid changes in the regulatory environment will support the adoption of policies and practices toward a low-carbon economic transformation over the next several years.

Building designs, constructions, and repairs of old stock with long lifespans are greatly affected by these needs. Market forces, the next generation of customers, and politicians are encouraging regulators to take action against climate change.

19. Proptech

The real estate industry is seeing a surge in property technology, or “proptech.” This trend involves using digital innovations to address challenges in the real estate market. This 2025, we expect to see more widespread adoption of AI-driven analytics, virtual reality property tours, and blockchain for secure transactions. These technologies aim to make processes more efficient, reduce costs, and improve the overall experience for both property managers and tenants.

20. Energy-efficient Upgrades

As environmental concerns grow, there’s an increasing focus on energy-efficient buildings. This 2025, we anticipate a rise in green retrofitting projects, where existing buildings are upgraded with energy-saving features. This might include installing smart HVAC systems, LED lighting, and better insulation. These upgrades not only reduce operational costs but also appeal to environmentally conscious tenants and investors.

21. Rising Costs

The commercial real estate sector is grappling with rising costs on multiple fronts. High inflation has pushed up prices for construction materials and labor. At the same time, more frequent and severe natural disasters have led to higher insurance premiums and payouts.

Insurance for commercial real estate properties isn’t just getting more expensive – it’s often becoming less comprehensive and harder to obtain. According to the National Multifamily Housing Council’s 2023 State of Multifamily Risk Survey and Report, over half of the respondents said their insurers added new policy limitations to reduce their exposure. Moreover, about 60% of respondents have had to increase their deductibles to keep their insurance affordable.

To tackle these rising costs, property owners and operators are exploring various strategies. Some are passing on the increased expenses to tenants through higher rents. Others are looking to cut operating costs by streamlining their financial processes. For instance, many are turning to treasury services to make their payables and receivables processes more efficient.

22. Market Recovery Opportunities

I’m seeing encouraging signs of life in the commercial real estate market after a period of uncertainty. With global dry powder of $382 billion (according to Cushman & Wakefield) waiting to be deployed and renewed investor interest following recent rate adjustments, I believe 2025 could mark the start of our next growth cycle. In my experience working with SMBs, this presents exciting opportunities in both leasing and investment, especially as property valuations stabilize and transaction volumes pick up.

23. Office Space Transformation

I’ve been watching the office sector undergo a fundamental transformation that’s affecting businesses of all sizes. With national vacancy rates around 12% (CRE Daily), I’m seeing companies completely reimagine their workspace needs. The trend is moving toward smaller, more flexible spaces that prioritize collaboration and modern amenities. In my view, this creates a perfect opportunity for SMBs to secure higher-quality space at better terms, especially since landlords are becoming more accommodating to tenant needs and building improvements.

24. Insurance and Construction Cost Management

I’ve observed dramatic increases in insurance premiums across all property types, with some sectors seeing double-digit annual growth rates. Construction costs remain about 40% higher across all asset types than pre-pandemic levels (Associated Builders and Contractors). From my perspective, SMBs need to carefully evaluate their insurance coverage options and consider creative approaches to renovation and build-out projects. I strongly recommend making these increased costs a key component of any real estate strategy.

25. Debt and Refinancing Challenges

I’m particularly focused on the significant refinancing challenge our market faces in the coming years. We’re looking at approximately $600 billion in loans maturing annually through 2028, totaling $2.3 trillion (Bloomberg) – what we’re calling the “wall of maturity.” Regional banks, holding about $2.7 trillion in assets, are becoming more conservative in their lending practices amid regulatory scrutiny. I advise SMBs to thoroughly understand this shifting lending environment and plan ahead for their refinancing needs.

26. Technology Integration

I’m increasingly convinced that artificial intelligence (AI) and property technology (PropTech) are becoming crucial in real estate operations. From my experience, technology can provide significant operational benefits, from optimizing space utilization to improving energy efficiency. I recommend SMBs focus on implementing practical technology solutions that improve decision-making and operational efficiency without requiring major capital investments.

27. Sustainability Requirements

I’ve noticed environmental considerations shifting from “nice-to-have” to “must-have” in commercial real estate. With the expansion of sustainable investment practices and growing regulatory requirements around carbon footprints, I believe businesses must prioritize sustainability in their real estate decisions. I often point SMBs toward energy efficiency tax credits through the Inflation Reduction Act, which presents opportunities to make sustainable improvements while potentially reducing costs.

Commercial Real Estate Trend for California in 2025

California has long been a national leader in commercial real estate. Major metropolitan areas like Los Angeles and San Francisco have established themselves as global financial and technology hubs that drive real estate demand. However, recent economic shifts coupled with the state’s high costs present new CRE challenges looking ahead to 2025.

Industrial Going Strong

Warehouse and logistics real estate continues to expand across California, representing one of the brightest spots in commercial property. The state’s established ports and transportation infrastructure coupled with unrelenting e-commerce growth fuels ongoing demand for new facilities. Investor appetite remains very robust for industrial space.

Offices Face Uncertain Future

California office markets face substantial unknowns moving into 2025. Remote work flexibility has slowed leasing velocity. Until the future of work materializes post-pandemic, significant excess space seems poised to linger. However, some markets better equipped for life sciences and tech firms may recover quicker thanks to tenant resiliency.

Opportunities in Distress

Financial stress among over-leveraged California landlords spiked dramatically in 2025 amid rapidly rising interest rates. With more loans coming due, default risks present opportunistic buying scenarios. Investors willing to inject fresh equity into properties shed at discount valuations can target future gains.

Smaller Cities Join Spotlight

Coastal market concentration and extremely high housing costs are two issues driving more commercial real estate attention toward California’s smaller metro areas. Markets like Sacramento, Fresno, and Bakersfield now represent growth alternatives, thanks to affordability, available space, and inward migration. These regions present new CRE plays for 2025.

In summary, from a flourishing logistics sector to an office market in limbo, California commercial real estate continues to face substantial uncertainties moving into 2025. However, among the challenges await chances for savvy investors to capitalize on distress while also tapping into sustained growth in warehouses and emerging inland markets.

Commercial Real Estate Trend 2025 FAQs

Is now a good time to invest in commercial property?

If you’re interested in investing in commercial property, now might be the perfect time to get started. Commercial real estate is one of the best ways to diversify your portfolio and ensure your future financial stability.

Do commercial properties go up in value?

Depending on the region, the state of the economy, and other circumstances, the annual return on the purchase price of commercial properties normally ranges from 6% to 12%. (such as a pandemic).

Is commercial real estate a growing industry?

Inflation still remains high, but commercial real estate growth has slowed. In comparison with previous quarters, apartment and office demand is lower.

What is the biggest challenge in the commercial real estate industry?

The biggest challenge in commercial real estate is adapting to changing market conditions, including rising interest rates, economic uncertainty, and shifting tenant demands due to remote work trends. This requires flexible strategies and innovative approaches to property management and investment.

What is the biggest threat to real estate?

The biggest threat to real estate is climate change. Increasing frequency and severity of natural disasters, rising sea levels, and changing weather patterns pose significant risks to property values, insurance costs, and the long-term viability of developments in vulnerable areas.

Conclusion

Overall, investing in the commercial real estate market can be a wise choice for those looking to diversify their investment portfolio and ensure financial stability. With property values that tend to go up over time, stable market conditions, and strong demand from tenants, a commercial real estate outlook remains a viable option for investors in 2025. However, it is important to do your real estate research and understand the emerging trends and market conditions in order to make the most informed investment decisions possible.

As you look ahead to 2025 and beyond, consider these commercial real estate trends. They may well shape the market in ways that provide opportunities for those who are ready to seize them. And if you need help navigating these waters, I am always here for you. Just give me a call or schedule a free consultation–I’ll be happy to chat with you about your plans and how we can help make them a reality.